Debt Review

Frequently Asked Questions

-

What is Debt Review?

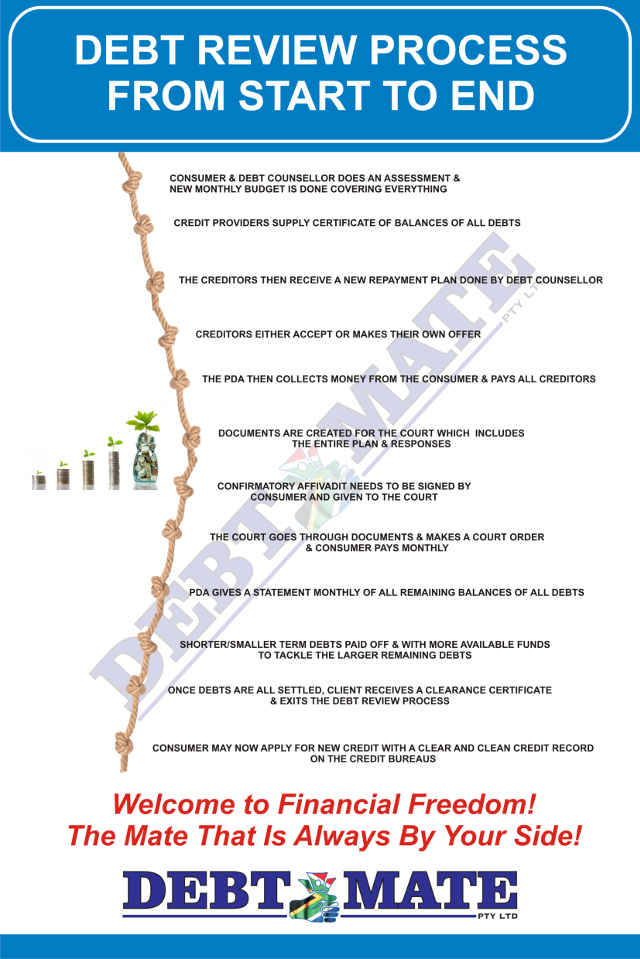

Debt Review was implemented by the National Credit Act (NCA) as a legal debt relief process. How it works is your Debt Counsellor proposes a reorganised debt repayment plan to your Credit Providers, allowing you to make just one lower payment towards all your debts each month. This plan is then declared a legally binding Court Order.

Thereafter, you will pay one affordable payment directly to a Payment Distribution Agency (PDA) once monthly. This payment will cover all of your unsecured debts and the PDA will divide it up between all of your credit providers.

If a secured Debt Is added part of the Debt Review process, We can negotiate better payment plan on your Secured asset and once all unsecured Debts are paid up, your debt counsellor will issue you with a clearance certificate. The credit bureaus and your credit providers will also be advised that you have completed the Debt Review process.

Accordingly, your credit profile will no longer show that you are under Debt Review and you will be able to apply for credit once again.

-

How do I know if I need Debt Review?

As a rule, you should contact us as soon you miss a payment and don’t see yourself being able to make any of upcoming payments. The sooner you get in touch the better – you have nothing to lose by doing so, but a lot to lose by putting it off. Just being on our website indicates that your debt situation is spinning out of control and you are in need of assisstance.

-

What are the costs involved with Debt Review?

The purpose of Debt Review is to provide you with debt relief, and as such, Debt Counselling fees are built into your affordable, reorganised debt repayment plan, taking your living costs and personal circumstances into account. Debt Counselling fees are also monitored by the National Credit Regulator to ensure that Debt Counsellor’s don’t take advantage of you, by charging you exorbitant fees.

Your Debt Mate Consultant will explain these fees to you upfront before you enter Debt Review, so you can rest assured that you’ll stay informed and be able to afford these with ease. Debt Counselling fees include an application fee, a restructuring fee, a small monthly fee, and a legal fee for the consent order.

-

Will my credit providers harass me, while I’m under Debt Review?

Your credit providers will be notified that you have entered Debt Review with Debt Mate within 2 – 5 days. Naturally, we aim to do this ASAP because as soon as we do, the law prevents them from contacting you.We will deal with your credit providers for you from that point on.Be warned that not all credit providers operate by the book, so if they do keep harassing you, just let Debt Mate know and we’ll make sure it does not happen again.

However, if your credit providers have already started legal proceedings against you with regard to a certain unpaid debt, we cannot prevent them from contacting you. Nor can we include this debt in your restructured repayment plan or have your payments reduced.As such, you won’t be protected from legal action with regard to this specific debt. This is why it’s so important to get a hold of Debt Mate, before your credit providers commence with legal proceedings.

-

Can I enter Debt Review if I’m unemployed?

In order to qualify for debt review, you will need to be permanently unemployed. This lets your debt counsellor know that you have a regular income, and in turn, you are able to afford your debt at a reduced rate. Being permanently employed also gives your lack of affordability more credibility to your creditors, who are the ones who need to agree to your reduced rates negotiated by your debt counsellor.

This is why it is important for you to understand your financial situation and look for solutions before things get out of control. Here’s a list of qualifying requirements for those who are thinking about going under debt review:

- You need to be a South African

- You need to be permanently employed

- You need to be over-indebted

-

How Long Will I Be Under Debt Review?

Everyone has a different amount of money they owe. Everyone has different credit providers. Everyone has a different amount they can spend on debt every month. So, everyone’s debt review plan is different and takes a different amount of time to finish.

Many things determine how long you have to be under debt review, including:

- How Much Debt You Have

- How Much You Are Able to Repay per Month

- The Interest Rates You Have to Pay on Each Debt

- The New Repayment Plan Your Debt Counsellor Negotiates

- How Committed You Are to Repaying Your Debt

-

Can I apply for credit or use my credit cards during Debt Review?

No. This is to prevent you from incurring more debt, as the purpose of debt review is to reduce your debt and work towards becoming debt free. Once you have settled all of your debts, Debt Mate will issue you with a clearance certificate and you’ll be able to take out credit again. However, we do hope you will be far more cautious going forward!

As soon as you qualify for the process, your debt counsellor will contact the credit bureaus to let them know that you are officially under debt counselling. The bureaus will then add an ‘under debt review’ flag to your credit profile. Whenever you go to the bank or a lender to apply for credit, they will run a credit check. When you enter debt counselling, your credit profile will indicate this fact. So, when credit providers draw a copy of your credit report, it will show that you are under debt review and they will thus reject your credit application however once you have paid up all your debts, you will be free to start taking on new credit.

-

Can I Cancel My Debt Review?

According to the withdrawal guidelines issued by the National Credit Regulator, neither a consumer nor a debt counsellor is permitted to terminate debt review.

You will then need to appoint an attorney who will need to obtain a court declaration order, declaring that you are no longer over-indebted. If a court order has already been issued, you will also need to appoint an attorney to rescind the court order on the basis that you are no longer over-indebted.

Alternatively if you are in a position to free up all your debts by settling your accounts if you have received a lump sum of money then Debt Mate can get settlement figures for you and assist you with ensuring your creditors payments are made and the debt counsellor will issue you with a clearance certificate. The credit bureaus and your credit providers will also be advised that you have completed the Debt Review process.

Accordingly, your credit profile will no longer show that you are under Debt Review and you will be able to apply for credit once again.

-

When I am under debt review, will my outstanding debt keep growing?

No! it will not, when placed under debt review all your accounts are frozen and the terms of repayment are negotiated by your debt counsellor. While you will receive better terms and longer repayment for the most part, you will still have to make payments each month. Missing these payments will be treated in the same way as before debt review. You will still gain interest and have to pay monthly, but the terms of the payment will be better suited to your situation, and therefore be easier to pay back monthly while affording to live, Every month as you pay toward your Debt Review balances, The balance will decrease and so will your Debt until all Debts are paid off and you become Debt Free.

-

Must all debt review clients go to court?

For debt review to be fully implemented, a court order has to be granted. This order order is put in place to legally protect consumers and their finances from being hassled by credit providers, as well as to halt any legal action creditors could try take against them.

The process with regards to granting a court order for a debt review case varies according to the jurisdiction of the court it has been sent to. Certain courts require the actual debt review client to be present at the court at the time of the court order, however in the vast majority of cases, the Magistrate’s Courts would rather allow the matter to be dealt with by our attorneys in the correct jurisdiction, rather than have to deal with it in court.

If the court’s jurisdiction does demand that the client is present and the client is absent, then they have the right to not grant the debt review court order.

- Item

- Property Bond

- Vehicle Finance

- Other Debt

- Total

- Old Payment

- R5,245.25 p/m

- R3,519.25 p/m

- R11,168.25 p/m

- R19,932.75 p/m

- New Payment

- R3,933.94 p/m

- R2,510.68 p/m

- R3,390.50 p/m

- R9,835.12 p/m

- Reduction

- R1,311,31 p/m

- R1,008.57 p/m

- R7,777.75 p/m

- R10,097.63 p/m